Processing a Full Refund of a Check Payment

Use this article for payments made with a check, cash or other external payment source

Payments that you record in ClassReach can come from

- Cash: The customer paid in cash

- Check: The customer paid with a check or money order

- Electronic Payment: If they paid via PayPal, Cash App, Apple Pay or another source

- Other: Some other form of payment

See the article Adding Payments for more details

Refunds of those different payment methods are done the same way. As we discussed in our intro article on refunding a payment, refunding always involves two basic steps

1) Recording the Refund

2) Adjusting the Balance

Recording the Refund

While it is possible to just delete the Payment Transaction instead of showing the refund, it is good bookkeeping practice to show the payment and the refund in the transaction register.

- Add a charge that says the refund was given to the customer

- Edit the payment transaction to zero out the refund charge by changing the invoice.

In the following example, the customer paid $511.11 as a monthly tuition payment that was due on Oct 1 - invoice #1006-046 with a check - #1965. Then, they realized they didn't want to pay out of that account and wanted to change their payment to a credit card. The school cut a check for the refund back to them which means that in the register below, the school wanted the Total Balance to return to $4600 and the Balance Due to return to $511.11, because the family still needed to pay the Oct 1 payment.

Step 1 - Enter a New Charge to Create a Refund Invoice

- Click Add Charge

- Enter the Category as Tuition - same Category as the original charge

- Enter the Amount as $511.11

- Enter the Description as "Refund for Check #1965"

- Click Save

Step 2 - Free up the original Check Payment Invoice

- Click Edit the Transaction on the $511.11 Check Payment (left side, down arrow).

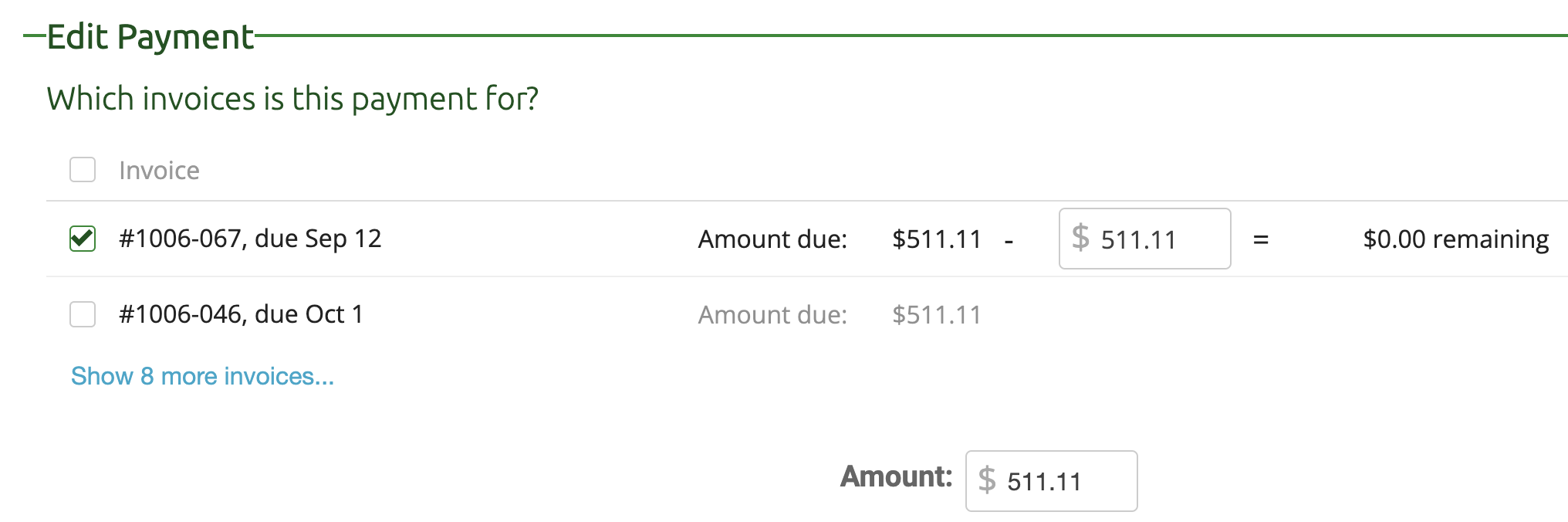

- Here we can see the invoice paid for by the $511.11 payment - Invoice #1006-046

- Uncheck that invoice - #1006-046

Step 3 - Reassign the Payment to the Refund invoice

- Remaining in the same place (editing the $511.11 payment)

- Check invoice #1006-067 (the new Sep 12 refund invoice). This will match the $511.11 check payment to the refund.

- Annotate the memo "This payment's invoice was changed from #1006-046 to #1006-067 when processing the refund."

- Click Save

Note on the Oct 1 invoice - #1006-046 is now considered unpaid, which is one of the desired end states, so the family will now be able to pay for that invoice with their credit card.

Adjusting the Balance

In this case, a balance adjustment was accomplished by adding the new charge to create the refund invoice.