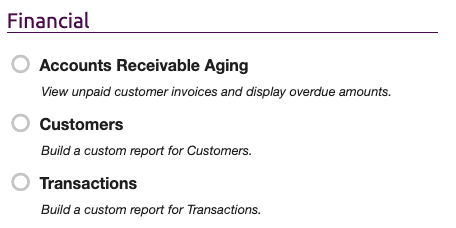

Financial Reports

This article describes the 3 Type 1 reports available for reporting on the Financial data in ClassReach

There are currently three Type 1 financial reports you can run in ClassReach to help you see your financial data. Beyond these three, we have added several detailed Type 2 Financial Reports. Please see Reports > +Report for the additional reports.

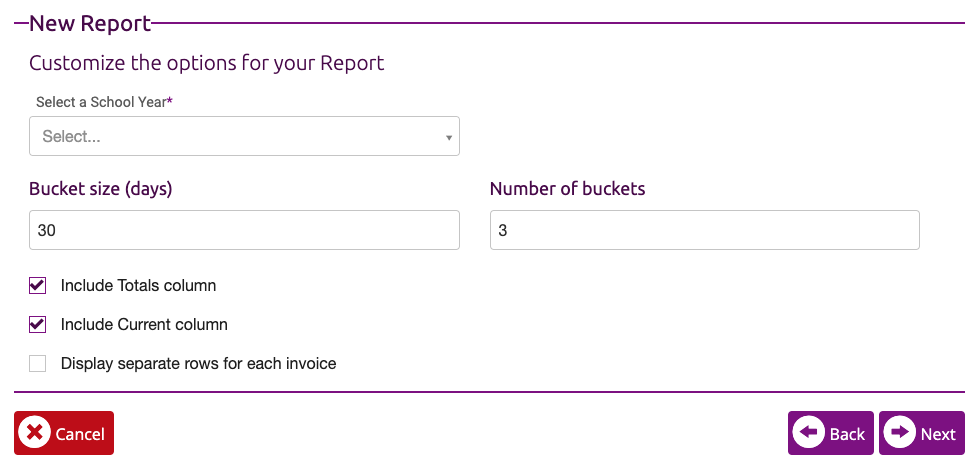

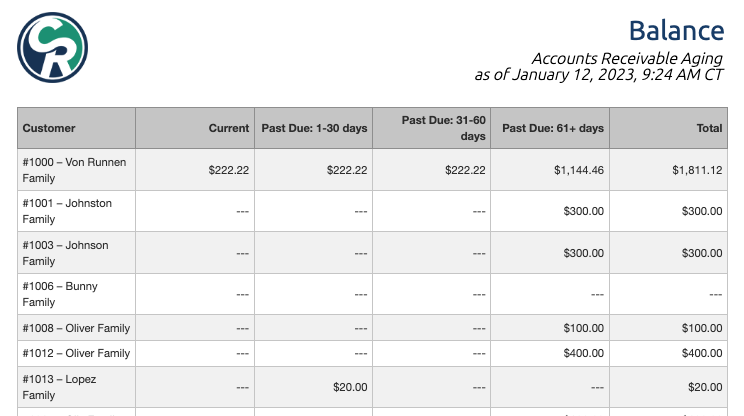

Accounts Receivable Aging Report

The Accounts Receivable Aging report allows you to report on unpaid invoices and the balance total due for families in your school. You can organize the report using the options below. Note that you have the option at looking at amounts due based on a certain number of days (bucket size) and then also a number of those buckets. This gives you some clarity on how late the invoices are relative to when they were due. The report can group together all the invoices by family or you can separate each invoice in a different row.

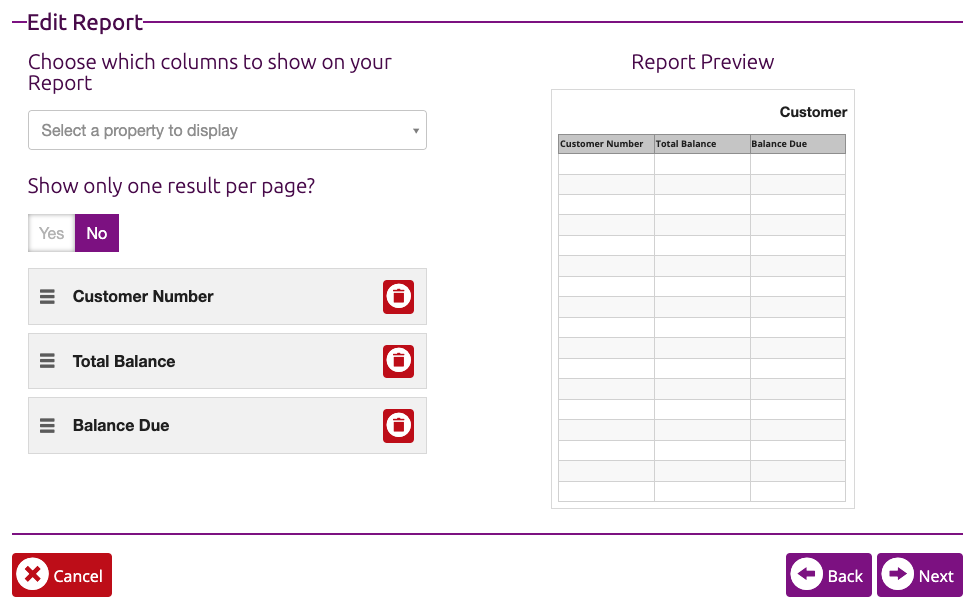

Customers Report

The Customers Report is a straight-forward reporting of your financial customers and their balances. You can use the advanced filter to limit the data reported, and the report is limited to the following data:

- Customer Name

- Customer Number - the financial customer number (found on the Financial Summary page)

- Total Balance - the total amount a customer owes the school

- Balance Due - the total amount the currently due for that customer. This excludes future payments

- Enrolled: YYYY - YYYY - if the customer is enrolled as a financial customer in a specified school year

- Balance Due: YYYY - YYYY - the total amount currently due for that customer for a specified school year

- Total Balance: YYYY - YYYY - the total amount a customer owes the school for a specified school year

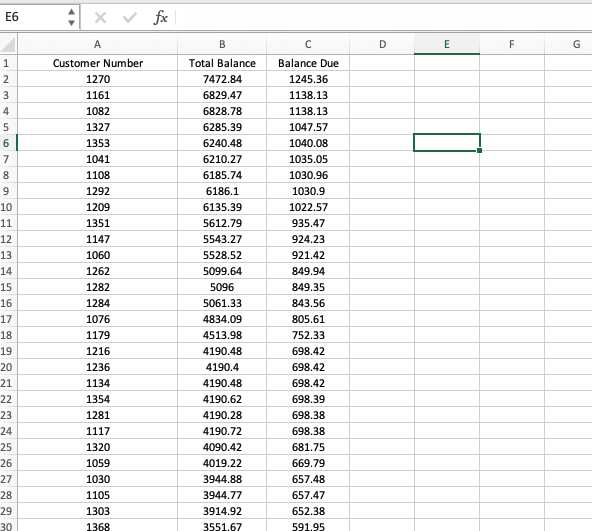

This is a CSV file output of this report shown in a spreadsheet and then sorted by Balance Due.

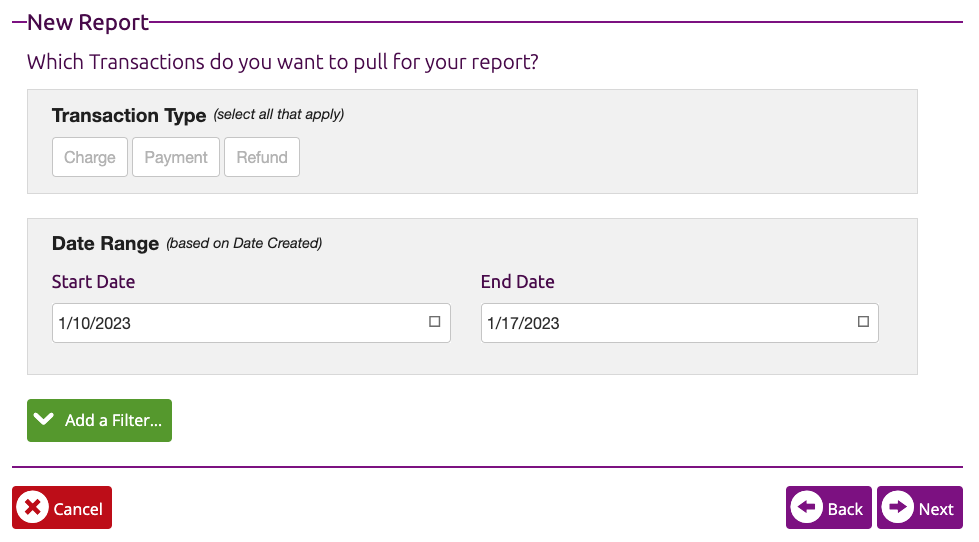

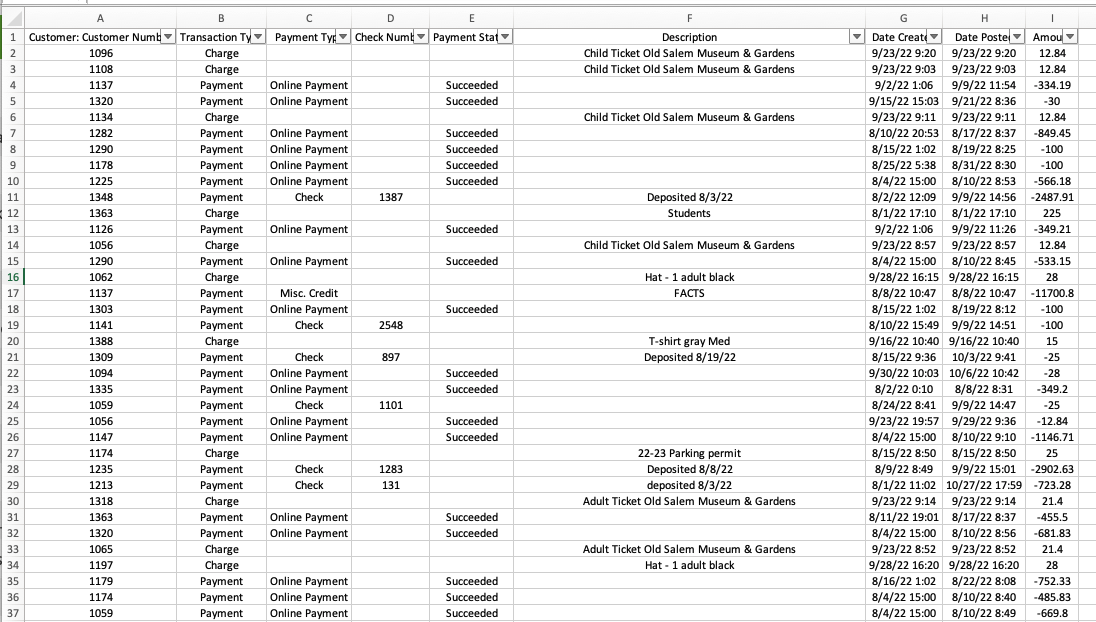

Transactions Report

The Transactions Report will give you data on Charges, Payments and/or Refunds in a specified date range. You can filter for a specific amount, specific names, etc. See our article Filtering Reports Like a Pro for details on this.

This report can also be output to a CSV file, which can then be filtered and sorted as desired in a spreadsheet.

There is different data available for Charges and Payments, but the most important thing to remember when looking at payments is that we usually don't have a description of the payment (what the payment is for) unless entered by the admin. This could be a normal part of accepting cash and check payments, but electronic payments come to us via a payment processing service (eg, Stripe) and typically don't have a description. This can be manually entered by the admin after the fact by editing each transaction. You can see this in the below example where most of the payments have no description except for a few checks.