Processing a Partial Refund of an Online Payment (via ClassReach)

Use this article for payments made online in ClassReach Financials via one of our payment processors

As we discussed in our intro article on refunding a payment, refunding always involves two basic steps

1) Recording the Refund

2) Adjusting the Balance

Recording a Partial Refund of an Online Payment

To make a Partial Refund, an admin can't use the Online Refund.

This article describes how to record the refund and adjust the balance by two methods - both would add a Payment (Misc Credit).

1) Partial Refund, Credit a Future Invoice

2) Partial Refund, money returned via Check or Cash

Partial Refund and Credit a Future Invoice

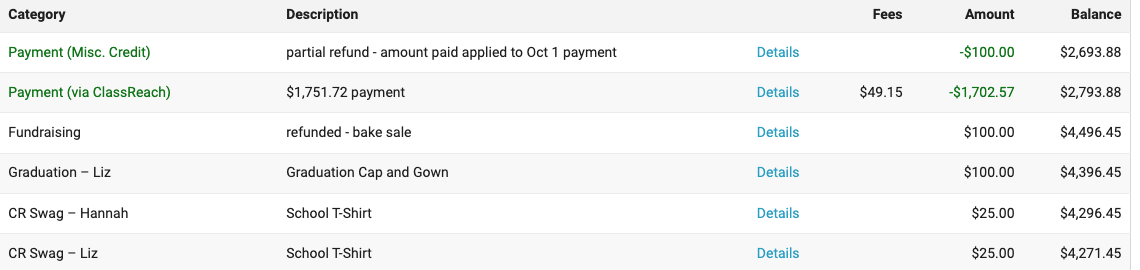

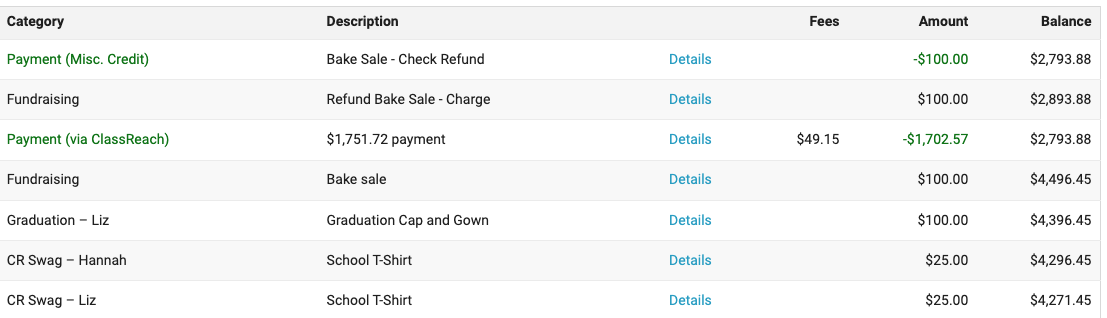

In the below example, the family is charged $100 for the bake sale (everyone in the school is charged $100 for supplies). They include this charge as part of a $1702.57 payment (this payment includes several charges against several invoices). Subsequently, the school cancels the bake sale and refunds every family the $100. A partial refund is necessary - $100 of the $1702.57 payment. The family wants the refund applied to their Oct 1 tuition payment.

STEP 1 - Free up the Bake Sale Invoice

We want the register to look like the above screenshot showing the $100 Partial Refund as a Payment (Misc Credit) in the above screenshot, but we can't enter that Payment yet. This Partial Refund Payment(Misc Credit) has to be applied to the Bake Sale invoice - #1309-015. That invoice is currently showing as a Paid Invoice by the $1702.57 payment.

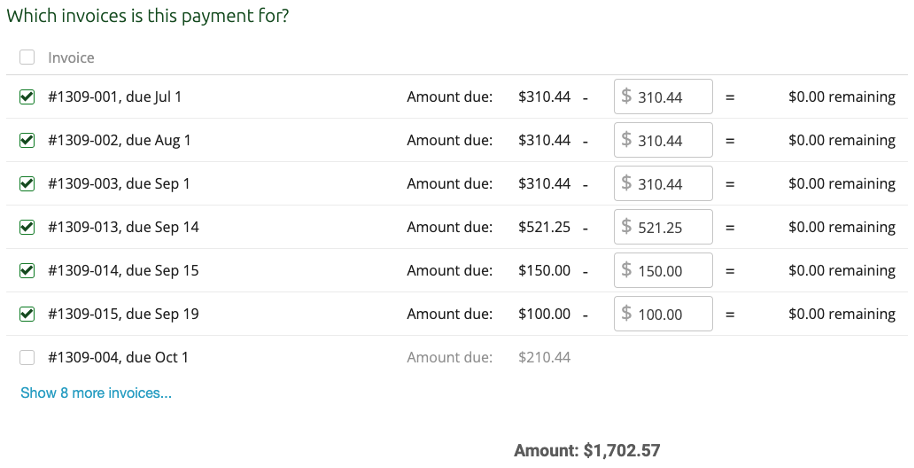

- We click Edit the Transaction on the $1702.57 Payment (left side, down arrow).

- We see the all the invoices paid for by the $1702.57 payment.

- The last one checked is the Bake Sale Invoice we want to refund.

- We uncheck that invoice - #1309-015

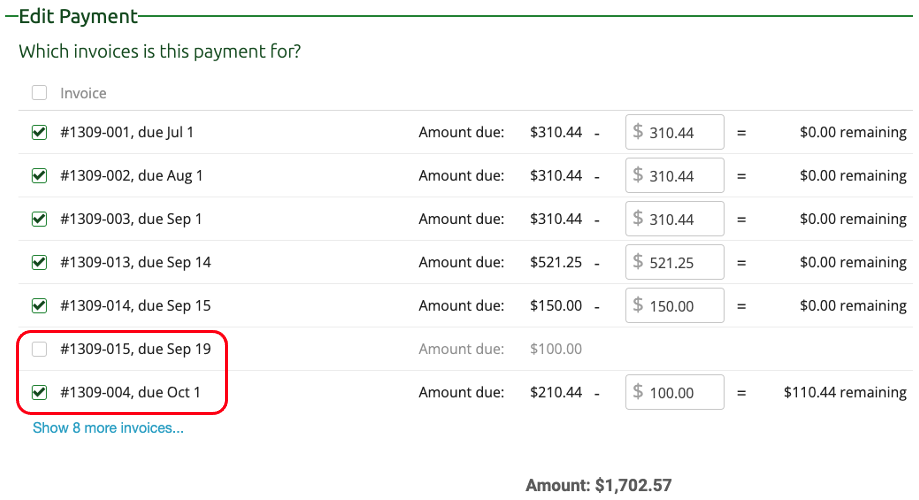

STEP 2 - apply $100 to the Oct 1 Tuition Invoice

- Remaining in the same place (editing the $1702.57 payment)

- We check invoice #1309-004 (the Oct 1 Tuition Payment). This will apply the $100 to that invoice instead.

- Click Save

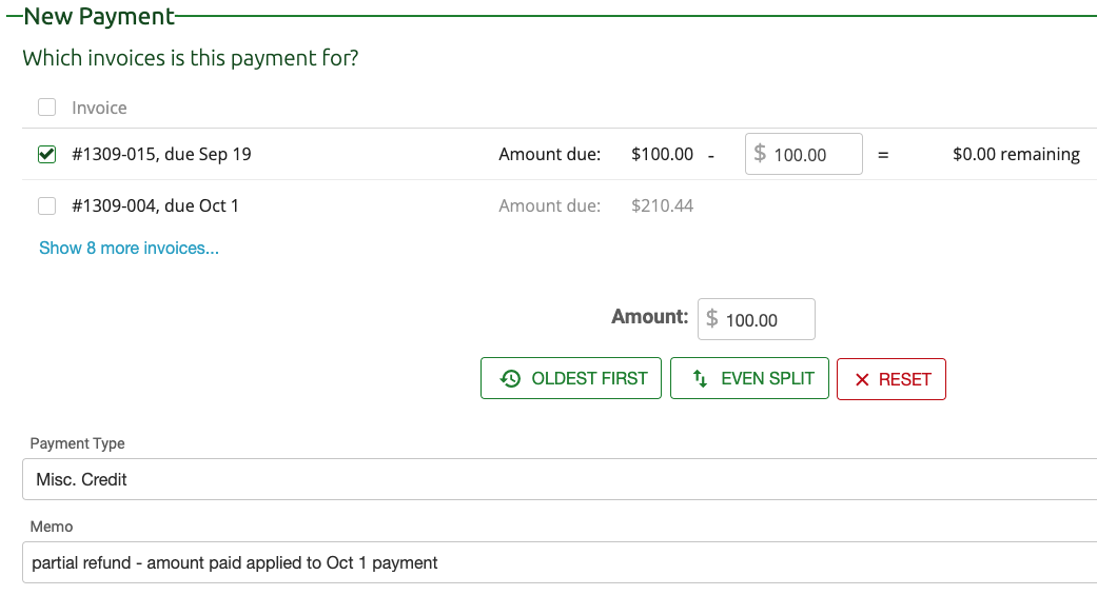

Step 3 - Add a Payment(Misc Credit)

- We click Add Payment

- We check the Bake Sale invoice #1309-015

- Select Payment Type as Misc Credit

- Enter the Memo stating "partial refund - amount paid applied to the Oct 1 payment." This means that we did a partial refund that is used to credit the Oct 1 Tuition payment.

- Click Save

Partial Refund via Check or Cash

The other option an admin has for a partial refund of an online payment is to return the money to the customer by writing them a check or giving them a cash refund. This partial refund would be entered in ClassReach as a Double Entry Charge and Payment (Misc Credit). A new invoice is created with the "Refund Bake Sale - Charge" and that same invoice is paid for with the "Bake Sale - Check Refund."

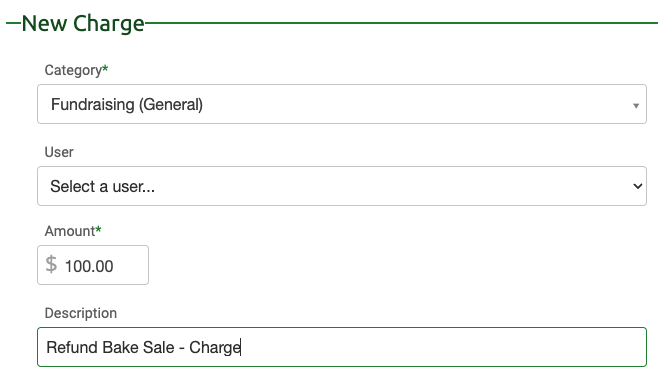

Step 1 - Enter a New Charge to Create a Refund Invoice

- We click Add Charge

- Enter the Category as Fundraising (General) - same Category as the original Bake Sale charge

- Enter the Amount as $100

- Enter the Description as "Refund Bake Sale - Charge"

- Click Save

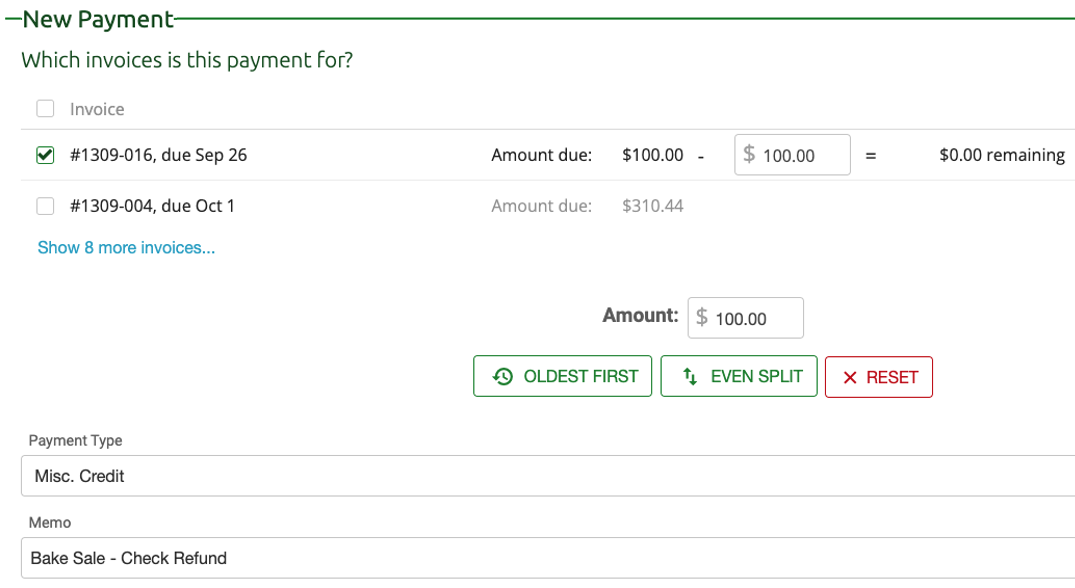

Step 2 - Add a Payment(Misc Credit)

- We click Add Payment

- We check the new invoice we created in Step 1 - #1309-016

- Select Payment Type as Misc Credit

- Enter the Memo stating "Bake Sale - Check Refund"

- Click Save